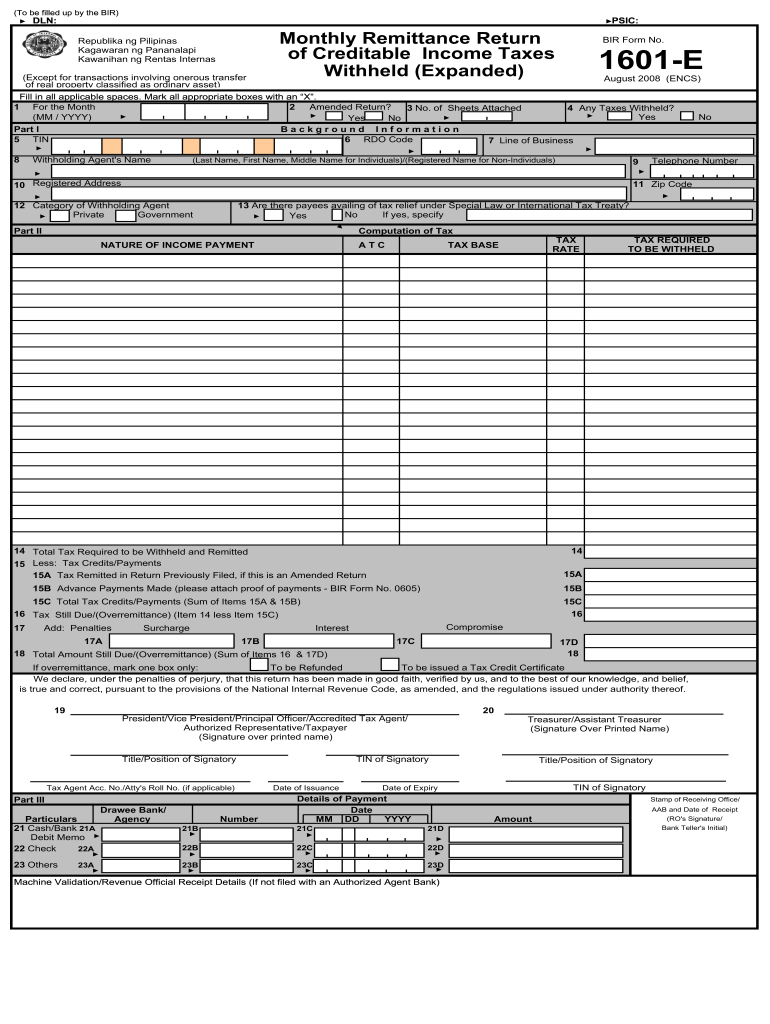

Who Needs BIR Form 1601-E?

BIR Form 1601-E is issued by the Government of Philippine. It stands for Monthly Remittance Return of Creditable Income Taxes Withheld. The form is filled out by a withholding agent who refers to the payers. The filer may be individual, corporation or even government entity. If so, then a return can be filled out by the employee designated for this purpose. If it’s a corporation a return must be signed and verified by the president of the company.

What is BIR Form 1601-E for?

The aim of the BIR Form 1601-E is to withhold and report tax on specific type of income. Say, you are a business owner. You rent an office where all your employees work. Naturally you pay rent to another person. It means that you’re a payer, and you have to withhold tax on the money you pay for the rent. The form used to withhold expanded withholding tax on different kind of income paid by one person to another for the services offered.

Is BIR Form 1601-E Accompanied by Other Forms?

The form isn’t accompanied by other documents. So you only have to provide the information that you’re asked in the document.

When is BIR Form 1601-E due?

The return as strict time frames. It must be filed by the 10th day following the month when the withholding was made. If you fail to file the return on time you will be penalized. The penalty is collected as a part of the tax.

How Do I Fill out BIR Form 1601-E?

Generally, BIR Form 1601-E is a brief and easy-to-use document. It consists of one page accompanied by instructions. The form is split into three parts:

-

Part 1 is for background information such as filer’s name, address, TIN, telephone number, etc.

-

Part 2 is created for computation of tax. It has 18 fillable fields where a filer must enter tax base, tax rate and final tax to be withheld

-

Part 3 contains details of payment.

Where Do I Send BIR Form 1601-E?

BIR Form 1601-E must be filed with the bank of the relevant Revenue District Office with the jurisdiction for the withholding agent’s place of work. A bank will issue a receipt or a special document that serves a proof of payment.